Unlocking Field Development Potential Globally

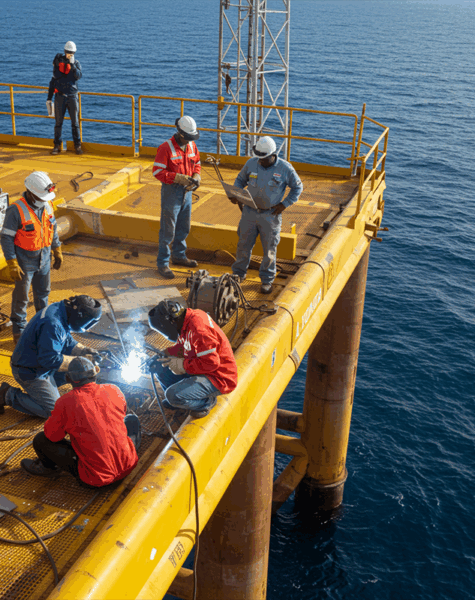

In today’s dynamic upstream environment, asset possession alone no longer guarantees commercial success. Oil block operators worldwide — whether in Sub-Saharan Africa, Latin America, the Middle East, or Southeast Asia — face a common set of challenges: constrained development capital, technical execution risks, and increasingly stringent regulatory expectations.

Pritch Energies Ltd offers an integrated solution: Financial and Technical Services Agreements (FTSA) — a fully aligned capital and engineering partnership model designed to de-risk, fund, and fast-track field development and production ramp-up globally.

The Global Challenge: From Discovered Resources to Sustainable Production

Across the world’s frontier, mature, and revitalized basins, operators are grappling with:

Pritch Energies’ FTSA model provides a holistic pathway to unlock commercial production while mitigating technical, financial, and operational risks.

What is a Financial and Technical Services Agreement (FTSA)?

A Financial and Technical Services Agreement is a customized, performance-aligned framework whereby Pritch Energies:

Core Features of the FTSA Model

Mechanisms: Reserve-Based Lending, Offtake-Linked Debt, Mezzanine Finance, Vendor-Backed EPC Contracts

Conditional disbursements based on verified technical milestones

Well delivery engineering: multilateral, extended reach, and sidetrack optimization

Surface infrastructure: Flowstations, Gas Processing Plants (GPP), Central Processing Facilities (CPF), FPSO tie-backs

Gas commercialization pathways: LNG, GTW (Gas-to-Wire), Compressed Natural Gas (CNG), LPG extraction

Production optimization: ESP systems, gas lift designs, intelligent completions

Bankable Offtake and Transport Agreements

Compliance advisory for host government requirements and international ESG standards

In-country fabrication, logistics support, and workforce development

Knowledge transfer programs integrated into project delivery

Global Markets and Operator Profiles We Serve

Indigenous and Independent Operators with marginal fields or acquired legacy assets

PSC and JV Participants requiring risk-aligned co-development support

Private Equity-Backed Platforms requiring technical execution bandwidth

Gas Field Developers focusing on midstream monetization or gas-to-power initiatives

IOCs/Asset Sellers looking for execution partners on divestment-linked commitments

Colombia, Argentina, Brazil (Latin America)

Iraq, Oman, Egypt (Middle East)

Indonesia, Malaysia, Vietnam (Asia-Pacific)

Pritch Energies: Your Global Partner in Field Delivery Excellence

By uniting precision financing with technical delivery discipline, Pritch Energies enables oil block operators to navigate complex development landscapes — de-risking execution, enhancing asset value, and securing sustainable production lifecycles.

Contact

- 20 Wenlock Road, London, N1 7GU United Kingdom

- +44 774 750 0371

- info@pritchenergies.com

Brochure

Download our brochure to explore our services, technical expertise, and innovative solutions for industrial and infrastructure projects.